Learn why it is such an integral and telling part of a company’s financial picture.With theindirect method, cash flow is calculated by adjusting net income by adding or subtracting differences resulting from non-cash transactions.

#Statement of cashflows example how to#

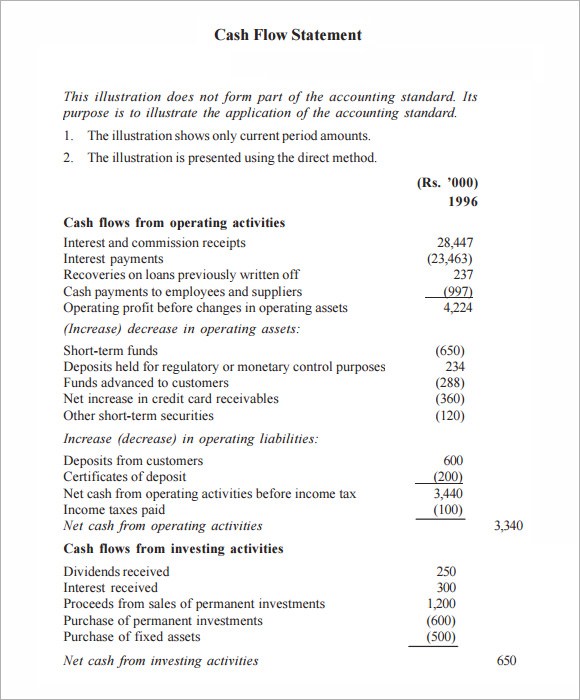

The how to prepare a cash flow statement step by step direct method is more time-consuming, because unlike the indirect method, it requires you to track operating cash receipts and payments for every transaction. One typical adjustment is for depreciation, which is a noncash transaction. You then adjust net income for any noncash items hitting the income statement. Negative cash flow should not automatically raise a red flag without further analysis. It means that core operations are generating business and that there is enough money to buy new inventory. The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors.

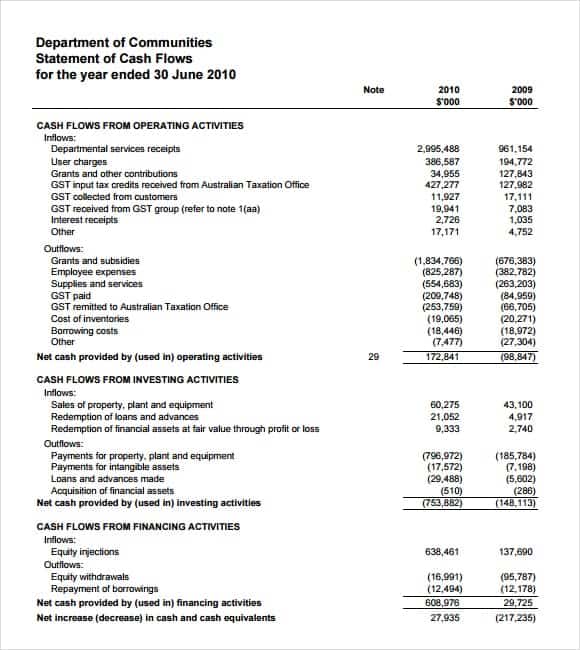

From this CFS, we can see that the net cash flow for the 2017 fiscal year was $1,522,000. The difference lies in how the cash inflows and outflows are determined. But the direct method provides greater detail about your company’s cash situation and, in turn, more potentially valuable insights. The indirect method is more common, for example, because it’s generally simpler and less time-consuming to perform. I want to know about the cash flow statement of a educational institutions like University by using indirect method. If you have your own business, you need to operate a company bank account to make sure your personal money, and the cash flow and profits of your business are… But even if your business is not publicly traded, a cash flow statement is incredibly important for tracking cash inflow and outflow. Your organization’s operating activities include everything that relates to how you generate revenue. Most basically, cash inflows are generated whenever customers buy your products or services outflows occur when you pay employees, suppliers, taxes or interest, among other things.

0 kommentar(er)

0 kommentar(er)